Buckle Up

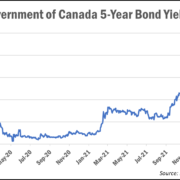

So most of the economists in Canada are predicting a 25 to 50 basis point increase to the over night lending rate tomorrow. This will mean that prime rate which effects our variable rate mortgages and home equity lines of credit will also go up by the same amount.

When you know something unpleasant is coming up around the corner does that make it any easier to bear? Stand still while I punch you in the face. You know it’s coming so anxiety of the anticipation may be worse than the actual damage itself. Sure we have had our share of increases in the past year so what’s one more. You have already punched me in the face 6 times this year, so what’s one more?

So the best advise is to buckle up and prepare for the worst, if … Read more