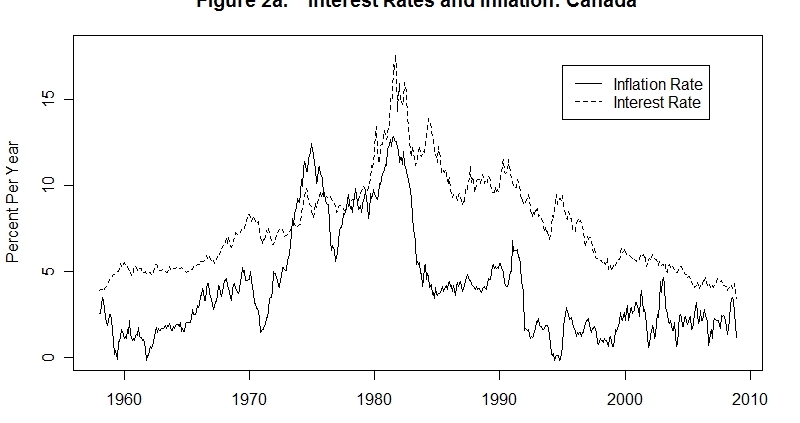

Inflation and interest rates

There is lots of talk about an impending increase to the bank of Canada prime lending rate. This is because inflation has been on the rise recently. Also rising inflation is usually a sign that the economy is doing well. While I do not profess to be an economist and can’t really give you any hard facts on GDP, I do see the costs of almost everything going up. The cost of gas has almost doubled since last year, most car lots are empty as they can’t get enough vehicles and year over year the cost of new homes in Halifax has increased by 21.2%

Now does that all point to a booming economy as the real reason for the prices of almost everything increasing. I think it’s more complex than that. Nationally we are still adding jobs, 31K in October alone. Yet at the same time minimum wage positions are being left unfilled as more and more people can’t make ends meets at our current minimum wage of 12.95/hour. There are no vehicles on lots mostly due to the shortage of computer chips to build them, thus creating a high artificial demand for new and used cars. Lastly our real estate market, normally Halifax has around 2,100 listings at any given time. Currently we are around 335, which is not enough to meet the demand thus further adding increase of home prices due to rampant bidding wars.

So if and when the Bank of Canada decides to intervene and increase the rates, I don’t think it will change anything. This is because the interest rate adjustment will not actually address the root cause of the increase of so many of the items that are effecting our lives at this vary moment. Having no chip shortage will allow auto makers to ramp up supply again, thus brining down demand and prices. Also when more building permits equal more home starts and more listings then that will release some of the pressure of our housing market. So while increasing rates in the past may have seemed like the right thing to do to keep a cap in raising inflation, currently I don’t think that is the logically solution.

“Inflation is when you pay fifteen dollars for the ten dollar haircut you used to get for five dollars when you had hair.” Sam Ewing

I look forward to your thoughts on this as well.

I look forward to hearing from you in regard to your mortgage needs.

Patrick

p.s- You can click on this link to start the process whenever you are ready. Schedule your meeting with me here.

p.s.s- I should tell you that I am licensed in Nova Scotia, Ontario(M18001555) & in British Columbia(BCFSA #504098).

p.s.s.s You can download my new mortgage app here