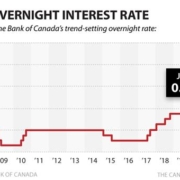

Bank of Canada sets key overnight rate to 1%

Well the Bank of Canada has done it again. They cut the key lending rate by another 50 basis points. So it is now at 1%. They are doing this because of the current world wide economic crisis, and the belief that our economy will shrink by another 1.2% this year. The central bank also said that the current global financial system must stabilize before any economic recover is to happen.

For those of you who have not been keeping track, the Bank of Canada has cut the key lending rate by 350 basis points ( or 3.5%) in the last 13 months. Some also say that there is a possibility for another rate cut at the next scheduled meeting in March.

The charted banks quickly reacted by lowered their prime rates from 3.5% to 3%. Even though they matched this rate cut point for point, don’t forget that they have not always done so in response to recent rate cuts. So even though the Bank of Canada is cutting rates to stimulate the economy, some of the banks are trying to hold on to some of that discount rather than pass it on where it is really needed.

This is important to you if you have a variable rate mortgage or line of credit. You are now paying less. However I would suggest keeping your payment fixed to a certain dollar amount so when and if it drops again you are paying more principal off of your loan. This will allow you to pay off your debt quicker.

Contact my office if you have any questions. I look forward to hearing from you.

Cheers,

Pat

p.s- You can find me on Twitter,Linkedin, Facebookand friendfeed.

Stumble it!

Stumble it!

Leave a Reply

Want to join the discussion?Feel free to contribute!